The set up for limited inventory

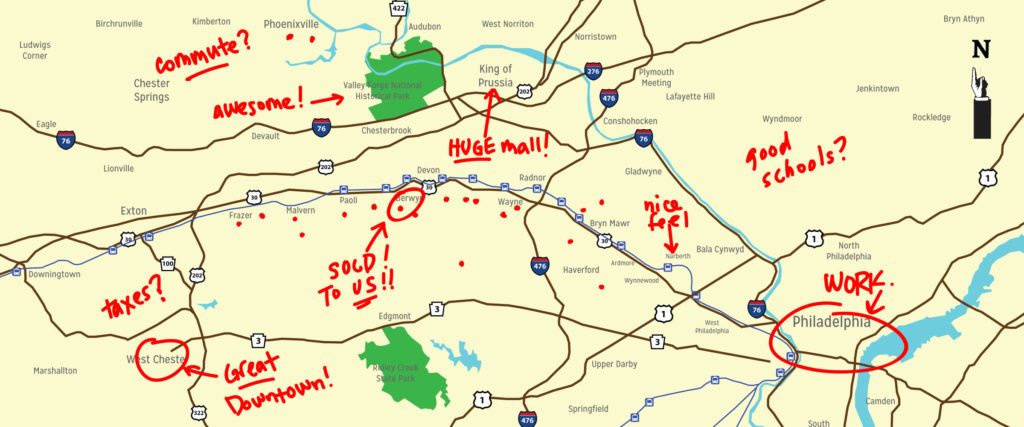

We have been fighting low housing inventory levels for a few years now. In my neck of the woods, suburban Philadelphia/Main Line, it’s always somewhat of a seller’s market. There are always more people wanting to buy than sell in this area. Several factors, though, have exacerbated the problem. First of all, our region became very popular during the pandemic. People fleeing tiny, city residences with no outdoor space (who no longer needed to be within commuting distances of workplaces in large cities like New York and Washington, D.C) found a lot to like here. Philadelphia is big enough to offer restaurants, museums, theater, professional sports, a good airport and is a reasonble distance to other destinations on the eastern seaboard. The Main Line also has very highly ranked public schools, which drew many relocating families here. The result: an increase in demand, with no corresponding increase in supply.

When interest rates rose

Competition for homes was fierce. Fast forward to 2022 when inflation was rampant and the fed responded by steadily and steeply increasing mortgage rates. There were fears of a recession and the cost of food skyrocketed. Tech sector (and other) jobs suffered major hits and lots of would-be buyers, for all the reasons above, decided to sit on the sidelines as far as home buying.

What may be less obvious is that home SELLERS can’t sell, unless they are prepared to be home BUYERS. And all of those same concerns affect them. The one that hasn’t received, in my opinion, as much attention as it deserves is the interest rate. A recent blog post from Keeping Current Matters, a real estate website says describes “rate-locked” homeowners:

Rate-Locked Homeowners

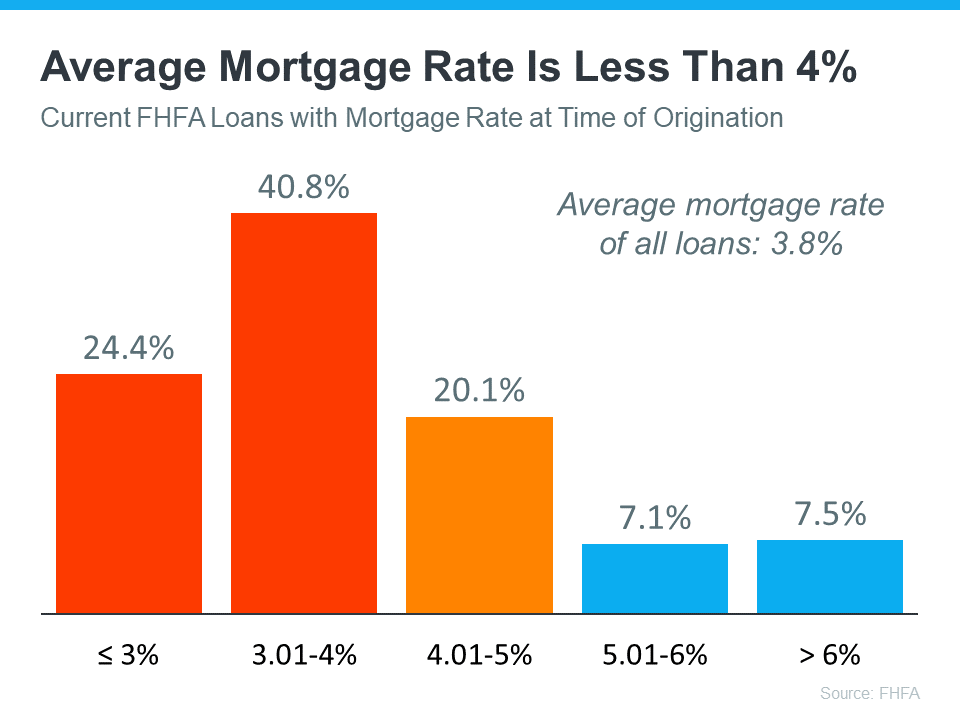

According to the Federal Housing Finance Agency (FHFA), the average interest rate for current homeowners with mortgages is less than 4% (see graph below):

An illustrative example with real numbers

Note that these figures reflect interest rates at the time of origination. Many homeowners took advantage of the low rates we were enjoying within the last few years and refinanced. Those people, and they were many, are not reflected in the data above. Today, in mid-July, rates are at 7.5%. To illustrate just how major an effect the difference in a 3.8% rate and a 7.5% rate is, consider this example:

A current homeowner bought his home for $870,000 and got an 80% mortgage at 3.8%. His monthly principal and interest payment is $3,597. If that homeowner wanted to keep the payment the same, at today’s rate of 7.5%, he could afford a $579,650 home with an 80% mortgage. How many people do you know who would be interested in that trade-off? Taking a big step DOWN and paying the same amount?

You might argue that many move up buyers are prepared to pay more than they are currently paying in order to have a nicer home. Agreed. Let’s see how much more someone would need to pay to move up to a property worth 20% more than their current home.

If the owner of the $870,000 home (which, in theory, is worth more now than when the homeowner bought it several years ago for that price, which means that to move “up”, it would probably be even a larger price jump than I am using in this example) decides that, to be worth moving, he’d want a house that he’d characterize as at least 20% “better” or “more valuable”. That framing means he’d be looking at home in the range of $1,044000. If he were to stick with an 80% mortgage, his monthly payment at today’s rate would be $6,194. Compared with the $3,597 he’s currently paying, that means he’s getting a 20% more valuable home for a 172% increase in his monthly payment. (That calculation, of course, doesn’t include additional costs for home owner’s insurance and, very likely, higher taxes.)

To be fair, the person selling that home that was purchased for $870,000 might have some considerable equity in the house, and since interest rates are much higher now than when the home was purchased, let’s assume the seller is planning to put more than 20% down in cash on the new home. To purchase that $1,044,000 home, in order to maintain the same monthly mortgage, of $3,597, he or she would have to put down more than 56% of the purchase price (around $585,000) in cash. That’s a lot of cash. Some people do have that much equity and will use it for the purchase of a new home. Many don’t, though. And, when you consider the additional “administrative” costs of buying and selling (real estate fees, closing costs, lender escrows, etc.), it is not hard to figure out why so few home owners find it financially wise to sell their homes right now.

The current landscape

The point is that if sellers feel like their low rate “locks”‘ them in their homes because the rates they’d have to pay to buy something else makes a purchase financially prohibitive, they won’t be buying. And if they aren’t buying, they aren’t selling! I think that this situation is playing a much bigger role in our woeful lack of inventory than many people realize.

It’s not totally hopeless; while this post has focused on home owners who would be looking to move only if they could get a “better” house, there are people who sell houses for other reasons. Sometimes a financial burden requires downsizing. Death, divorce, job changes and other life events can also trigger a sale. So there still are people who will list their homes for sale. However, a large portion of the “move-up” buyer group, which often represents a good chunk of the listing market, has decided to sit on the sidelines for the moment. That choice translates into a dearth of housing inventory.

While I’d love to end this post on a high note, by telling you that I expect to see a shift soon, with the supply in demand imbalance easing, the truth is that I cannot. While there will always be cylcles to the housing market, I don’t see a measurable change any time in the immediate future. Only time will tell.

If you are relocating to the Philadelphia/Main Line area, please go to my blog page and search for posts using the relocation tag. Contact me to discuss your Philadelphia area relocation! jen@jenniferlebow.com/610 308-5973

5

Leave a Reply