New construction buyers use the builder’s rep

New construction communities always have agents on site. Lots of prospective buyers wander into those sales offices, take a tour (given by the on-site agent) and move foward with a purchase, never bringing in their own buyer agent. In most cases, this scenario happens because buyers don’t know any better and because the builders consciously try to take advantage of that lack of knowledge. Those on-site agents want to represent potential buyers (as well as the builder) because they make more money that way and because they often lead buyers to believe that there is “nothing to negotiate” when it comes to new construction. While sometimes, true, there are circumstances where a good buyer agent can negotiate successfully for a new construction buyer.

Don’t use the listing agent

Remember that the agents who are on site have a confidentiality and fiduciary responsibility to the builder. They are NOT going to be working in your best interest–and this fact is true with any home sale, not just new construction. Buyers should never expect the same kind of representation from a listing agent as a buyer’s agent who has no obligation to protect the seller’s interest.

Advantages to using a buyer agent for new builds

A buyer agent:

- Should point out hidden costs. New construction hides a slew of hidden costs. From lot premiums to upgrades to HOA fees and high taxes, uninformed buyers take a major risk of missing important fees if they don’t have a buyer agent representing them.

- Is not employed by the builder. A buyer agent owes no allegiance to the builder and will, therefore, be more likely to provide an honest opinion of the builder’s reputation. Along the same lines, many buyer agents encourage pre-drywall inspections. These inspections are done to be sure the plumbing, electrical and other systems are installed correctly, without cutting corners, before the drywall covers them up. Listing agents representing the builder don’t suggest these.

- Will explain about upgrades and the “model”. Most builders build a model home, purportedly designed to enable prospective buyers to get a feeling for what they could build if they chose that model. The issue I have is that, while the sales rep (the builder’s agent) always says that their base model (with no upgrades) is quite well -appointed, that model inevitably reflects tons of costly upgrades–often up to 40% or more of the base price. So the model does NOT accurately represent what you would get unless you are prepared to spend way more than the base price. A good buyer’s agent will find out how much in upgrades the model home has and what the average buyer spends on upgrades (usually around 20% of the base price). Furthermore, she should be able to recommend which upgrades will hold their value and which might not provide a good return on investment. Finally, savvy buyer agents can tell you which upgrades are better done after the home is built, by outside contractors. For example, paying the builder to add a patio/deck or finish a basement is usually more costly than having it done by a separate contractor.

- Should explain lot premiums. Most builders have lot premiums on most or all of the lots available. This additional cost (which could be $30,000 or more) reflects the desirability of a lot. It may have to do with location in the development, the hilliness of the site, whether it has a more or less private back yard, if it’s in view of concrete water management pipes, etc. You’ll want to fully understand what the lot will look like, especially because what you see prior to construction is often very different that what you see once it’s been excavated and the house has been built. Most buyers are not familiar with reading the site plans showing the elevation changes and don’t know how to interpret them. Your buyer agent should help with that.

- Will find out what the HOA fees and rules are. Sometimes builder’s agents gloss over extra fees for certain amenities leaving new owner suprised that they are not covered by the HOA cost. Furthermore, you’ll want to be very clear about what is and isn’t covered by the HOA. Glass sliders to your deck? Snow removal of just the street or your driveway, too? Plantings or yard maintenance? Also, there are rules about what your mailbox can look like or what color you can paint your shutters. Some communities don’t allow spot repairs on roofs; they require the owner to pay for a whole new roof. Many development prohibit parking RVs or boats in the driveways and often don’t allow parking along the street (think of where your guests can park). Lot a to find out as far as rules/regulations and fees associated with an HOA.

- Will explain what builder’s warranty does and doesn’t cover. A good buyer agent will ask for a copy of the builder’s warranty before having you sign the commitment to purchase. He will make sure you understand what is covered and what the time periods for coverage are.

- Will review the Agreement of Sale with you. Builders don’t use the standard state Agreement of Sale used in most resale transactions. They all have their own and they are heavily skewed to protect the builder. For example, most have a clause stating that the buyer agrees that the builder can have up to at least a year (sometimes more!) past the agreed upon settlement date to deliver the home. They cite that they cannot be responsible for delays cauased by weather or supply chain problems. They do not address the fact that a significant delay could result in a major financial setback to the buyer (what if you have to rent a house or something due to a long delay?). They also mention that they can subsitute materials for the ones you’ve chosen in the event the original ones are no longer available. However, you have no recourse in these situations–what if you dislike the replacement? So make sure your agent thoroughly reviews the agreement with you. I guarantee that if you work with the builder’s agent, those kinds of points will NOT be highlighted.

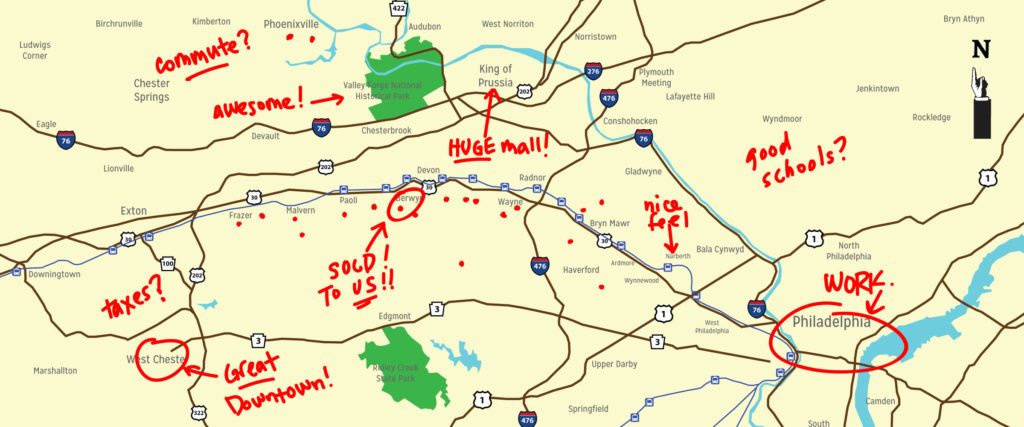

- Should ask about taxes. New construction listings only show taxes on the land, as the taxes for the property once the home is built is only assessed AFTER it’s completed. Therefore, you may see a listing and think, “Oh, what low taxes!”. That’s because it’s only for the land. Your agent will find out what the tax rate is and ask if people have been successfully appealing their taxes. Tax appeals on new construction in PA are often successful. To understand how and why you would appeal taxes, click here.

- Will address other new construction in the area/on site. Your agent should find out if the area where the new development is will be growing and what new retail/schools/services might be coming in. That information may affect your decision about whether to build in the development. Additionally, you’ll want to know, within the community itself, how much construction will be happening and for how long. Are they expecting to be building continually for the next 18 months or are they nearly finished? Note that there are pros and cons to being one of the first sales or one of the last in a new community. You will usually have better pricing and lot choice early on, but you’ll have to live through construction of surrounding homes for longer. If you buy when most of the homes have already been built, you’ll have less choice as far as site and the prices will be higher, but you won’t have the noise and mess associated with construction.

- Will negotiate for you. While it’s true that you can rarely negotiate the price of new construction, it is sometimes possible to negotiate to have certain upgrades thrown in for free or for a reduced price. The builder’s agent has no incentive to try to reduce your costs, but a buyer’s agent who doesn’t work for that builder has nothing to lose by at least trying. There may be specific changes or extras that they are willing to do if expressly asked, but they won’t offer them. Your agent should be willing to go to bat for you to see if the builder will accommodate your needs.

- Should help you with the punch list. Most buyers don’t know that they have the right to delay settlement if there are things that have to be corrected–if trim is missing or something needs to be repainted, etc. Your buyer agent can help you identify the concerns and be sure the builder makes them right before you settle.

The list above is by no means exhaustive; I’m sure there are plenty of other reasons it makes sense to use a buyer agent who is not affiliated with the builder when purchasing new construction. These points were simply the ones that occured to me immediately. As I stressed at the beginning of this post, using the listing agent is always risky as he or she is already committed to protecting the financial interests and privacy of the seller. In order to fulfill those responsibilities, it is nearly impossible for that person to warn you of all the potential pitfalls and considerations you should be thinking about. I don’t ever recommend using the listing agent if you are a buyer.

Historically, people have been led to believe that with new construction, there’s no negotiating and no reason to use a buyer’s agent. I hope that this post has challenged that belief!

If you are relocating to the Philadelphia/Main Line area, please go to my blog page and search for posts using the relocation tag. Contact me to discuss your Philadelphia area relocation! jen@jenniferlebow.com/610 308-5973